Sohu: A Stock for Value Investors (NASDAQ: SOHU)

shining stars/iStock Unreleased via Getty Images

Investors might consider investing in Sohu (NASDAQ: SOHU) as a bargain opportunity. Based on fundamentals, there is no obvious reason why the stock should be trading at a steep discount to book value of around 50%. In this article, I appreciate the SOHU base on a residual income framework. I apply analyst consensus estimates through 2025, a WACC of 9% and a terminal value growth rate equal to nominal GDP growth. My math implies that SOHU is currently >30% undervalued, based on a base target price of $19.95/share. To buy.

About Sohu

Sohu Inc. is a leading online media, video and game company based in Beijing, China. The company is active in three vertical sectors: information, communication and entertainment. News is arguably the company’s main and most successful business activity, as Sohu operates China’s most popular online news platform/application. Recently, Sohu has seen increasing success through the company’s gaming business, Changyou, which mainly focuses on online multiplayer games. Finally, Sohu also operates a search engine platform through the Sogou subsidiarywhich is also partly owned by Tencent (OTCPK:TCEHY) – which retains a 38.2% stake.

Sohu generates revenue primarily through the company’s gaming platform, which accounts for just over 85% of total revenue, and online advertising services such as ad/brand placement and paid collaboration with advertising agencies. press, which represent less than 15% of revenues.

It should be noted that Sohu was ranked by Fortune as the third fastest growing company in the world in 2009 and the world’s twelfth fastest growing in 2010. However, Sohu’s period of strong growth is over as the company has failed to increase revenue much since 2015. The lower growth expectations are reflected very well in the company’s share price, which is moved from an ATH of $67/share in 2017 to mid-teens as of May 2022.

The Value Thesis

But it can be argued that growth is not the only aspect that gives value to a company. In fact, there is also the ability to generate cash flow and balance sheet value. And I think that’s the aspect that the market underestimates. In 2021, Sohu recorded an operating profit of $97 million. Even during the recent first quarter of 2022, which was really difficult for Chinese companies due to multiple headwinds such as an economic slowdown and lockdowns in China, Sohu managed to remain profitable with a GAAP net profit attributable to shareholders. of $3 million.

On the balance sheet, in particular, Sohu has over $1.4 billion in cash and short-term investments and no financial debt. For reference, if we take the company’s current market capitalization of $540 million, we can calculate a price-to-book ratio that is significantly

That said, Sohu comes across as a real stock of value. But investors might wonder if the company is also a value trap? Personally, I don’t think so. The company’s business operations appear structurally very profitable with net profit margins > 10%, taking into account the current difficult macroeconomic environment. Moreover, the forecasts of consensus analysts do not indicate any deterioration in the fundamentals. At the end of May 2022, the Bloomberg Terminal reports consensus revenue for 2022, 2023 and 2024 at $747 million, $759 million and $754 million. EPS is estimated at -$0.1, $0.22 and $0.55 respectively.

Evaluation

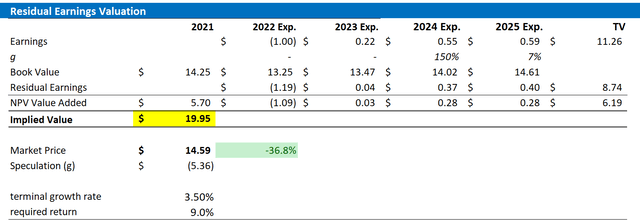

I value Sohu based on a residual earnings framework and anchor my estimates on the following assumptions:

- I base my EPS estimates on analyst consensus through 2025.

- I apply the CAPM model to derive the cost of equity and in a second step I calculate the WACC (9%) according to the trading leverage. I think 9% is very reasonable because it balances the low-risk assets on the company’s balance sheet and the premium on Chinese equities.

- As for terminal growth rate, I think zero growth is adequate, although it may not be underestimated.

Based on the assumptions above, my calculation returns a base target price for Sohu of $19.95/share. Thus, Sohu appears significantly overvalued. Most notably, undervaluation is relatively low risk since most of the value is already on the balance sheet, not speculative value stemming from long-term earnings expectations.

Consensus of BPA analysts; Author’s calculations

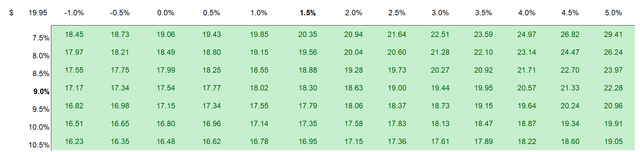

I have also attached a sensitivity analysis based on a variable combination of WACC and TV growth, so investors can evaluate Sohu based on which scenario best reflects their fundamental view. For reference, red cells imply overvaluation relative to the current market price, and green cells imply undervaluation. Needless to say, the image looks very appealing to Sohu.

Consensus of BPA analysts; Author’s calculations

Risks

Investors should be aware of the following risks/challenges that could prevent the stock from reaching the target price as calculated in the review section:

First, Sohu’s scope of competition is quite wide as the company is engaged in both online advertising and gaming. That said, when it comes to games, the company has strong competitors, including Tencent and NetEase (NTES). When it comes to advertising, Sohu competes for advertising budgets with giant Baidu (BIDU). Additionally, Sohu is impacted by changes in user behavior and competition with video streaming platforms such as Bilibili (BILI).

Second, since Sohu is based and operates in China, the company is exposed to increased risks political risks while the CCP aims to regulate technology/internet companies and ADR registration dispute has not yet been resolved. That said, negative investor sentiment towards Chinese equities could cause the stock to trade at unreasonably low multiples until sentiment improves, if ever.

Third, a significant economic slowdown in China, due to Covid shutdowns, housing crisis and inflation, could have a significant impact on the financial health of Sohu’s business/advertising partners and customers. Thus, if the challenges prove more severe and/or last longer than expected, the company’s financial outlook, including EPS estimates, should be adjusted accordingly.

Conclusion

Sohu seems undervalued. As the company has a track record of profitability and analysts expect sustained profitability going forward, there is no reason for Sohu to trade at such a steep discount of nearly 50% to book value. That said, the residual earnings valuation framework indicates a significant undervaluation of >30%. I initiate with a BUY recommendation and set a target price of $19.95/share

Comments are closed.