Cisco stock is a good hedge against tech volatility (NASDAQ:CSCO)

raisbeckfoto/iStock Unpublished via Getty Images

Introduction

As a dividend growth investor, I am always on the lookout for additional dividend growth opportunities. Sometimes I look at stocks of companies that I don’t have in my portfolio that can give me exposure to new industries. At other times, I look at companies I already own in my portfolio and consider adding more if the valuation and growth prospects are intact.

In this article, I will analyze an existing position in my dividend growth portfolio. Cisco (NASDAQ: CSCO) is an IT company that I have owned in my dividend growth portfolio for years. The company isn’t as trendy as some of today’s tech leaders, but it has paid a steady and growing dividend.

I will analyze the company using my dividend growth stock analysis methodology. I use the same methodology to facilitate the comparison of the stocks analyzed. I will examine the fundamentals, valuation, growth opportunities and risks of the business. I will then try to determine if it is a good investment.

According to Seeking Alpha’s company overview, Cisco Systems designs, manufactures and sells Internet Protocol-based networks and other products related to the communications and information technology industry in the Americas, Europe, the Middle East, Africa, Asia-Pacific, Japan and China. . It provides infrastructure platforms, including networking technologies of switching, routing, wireless and data center products designed to work together to deliver networking capabilities and transport and /or store data.

Wikipedia

Fundamentals

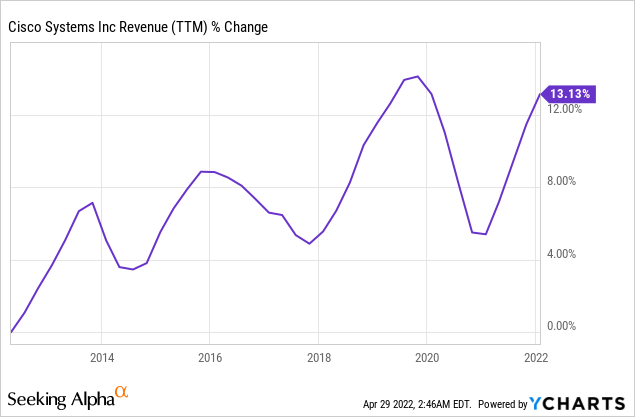

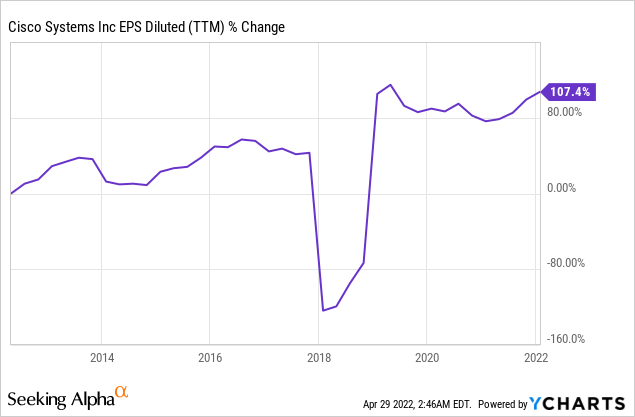

Cisco has seen revenue increase by just 13% over the past decade. This means that over the past decade, the company has grown less than 1% annually. Growth is slow and has begun a transformation of the business over the past decade. The company is shifting its business model from hardware to software and focusing on EPS. Going forward, analyst consensus, as seen on Seeking Alpha, expects Cisco to continue to grow sales at an annual rate of around 5% over the medium term.

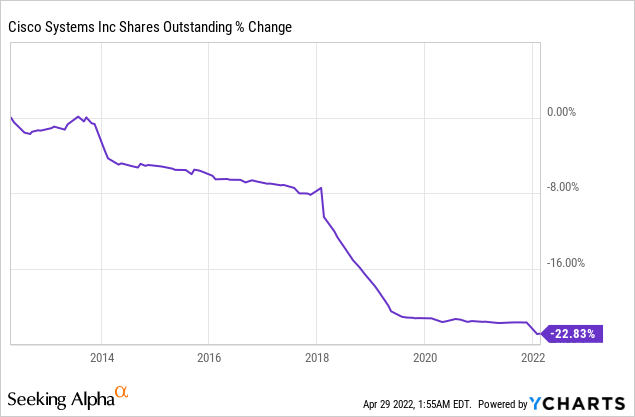

The business transformation had a profound impact on EPS (earnings per share). While sales remained somewhat flat, EPS more than doubled. This is the result of the change in business model as software sales have higher margins, and due to buybacks it has decreased the number of shares. Going forward, analyst consensus, as seen on Seeking Alpha, expects Cisco to continue to grow EPS at an annual rate of around 7% over the medium term.

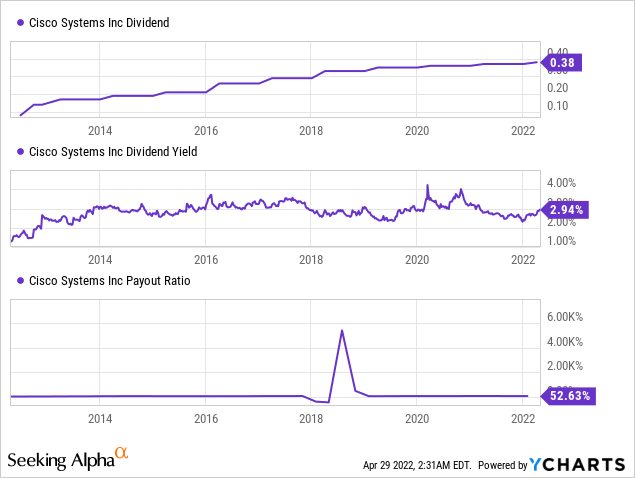

The company has been paying dividends for a decade now. It kicked off its dividend payouts when Apple (AAPL) did so as part of a wave of mature tech companies that began sharing the wealth with shareholders. The dividend is extremely safe with a payout ratio of around 50%. Additionally, the company’s current yield is attractive at 3%, and investors should expect future increases to be in line with the company’s EPS growth rate.

In addition to dividends, companies can return capital to shareholders through buyouts. Buyouts are extremely effective when the company is attractively valued. It must be exercised when the company has a cash surplus after dividends and growth investments. This is the case of Cisco, which is transforming its business and can still afford to buy back nearly a quarter of its shares over the past decade.

Evaluation

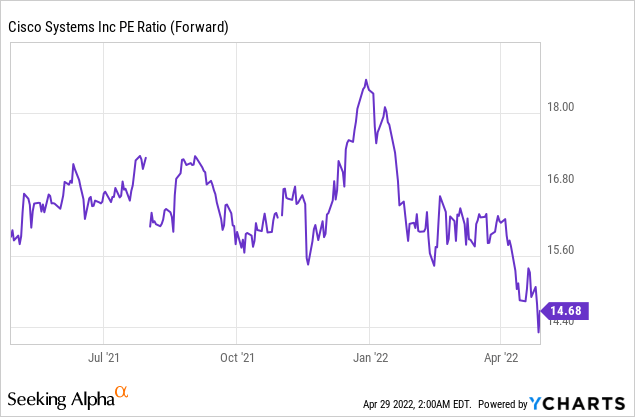

The company’s P/E (price to earnings) ratio stands at 14.7 taking into account analyst consensus for 2022. This is the lowest valuation the company has traded for over the past twelve months, and with a P/E ratio below 15, Cisco could be attractively valued. Although the company may not be growing in double digits, the current valuation may still be attractive for a company with strong mid- to high-single digit growth.

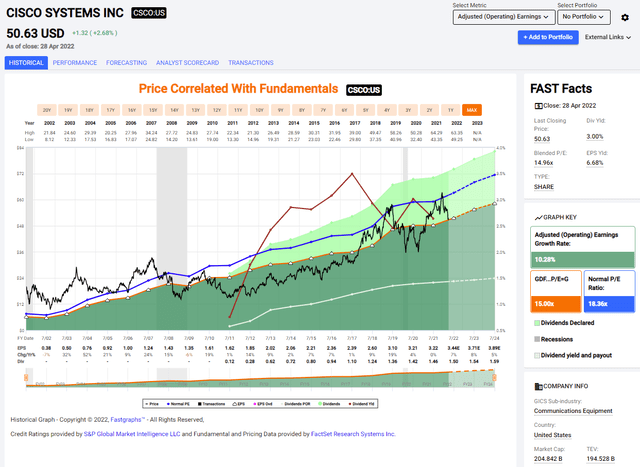

The chart below from FAST Graphs highlights that Cisco is trading below its average valuation. Over the past two decades, the company has traded at an average P/E of 18.3. Currently, the company is trading at less than 15 times its earnings. It is important to note, however, that the projected growth rate is also lower than the average growth rate of the past two decades, which was 10%. However, I believe that stocks do not deserve such a discount, especially when Cisco is showing stability and resilience.

QUICK charts

In conclusion, Cisco, unlike some of its software peers, is not experiencing exponential growth. The company is shifting its model to software and continues to grow sales and EPS, fueling both dividend increases and buybacks. This solid set of stable growth is trading for an attractive valuation in today’s volatile market, and if Cisco has enough growth opportunities, it will be a suitable dividend growth company for your portfolio.

Opportunities

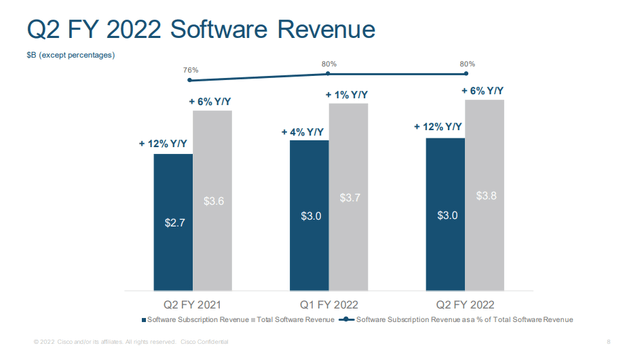

The first opportunity is the new economic model. Cisco has traditionally been a hardware company, and hardware is typically sold at lower margins than software. Therefore, the company is shifting its business and revenue towards subscription software revenue. Software revenue already accounts for more than 25% of company revenue, and 80% of that revenue is subscription-based.

Cisco Q2 Revenues

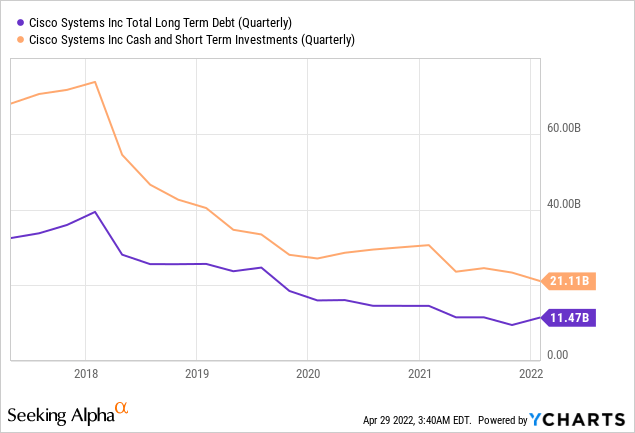

In addition, the company has an extremely flexible balance sheet. The company has $11.5 billion in debt, but it also has more than $21 billion in cash and short-term investments on its balance sheet. This is an opportunity as we see market volatility and some companies are suffering from a significant drop in share price. Cisco is ready with a strong cash position and the ability to take on debt, and it will be able to acquire attractive businesses that can support future growth.

The third possibility is the margin of safety. The company trades at less than 15 times forward earnings. This gives investors some safety margin if the forecast is lowered or the market remains volatile. Cisco investors will benefit from the regular dividend payout and the margin of safety in the face of a future storm due to market volatility.

Risks

The first risk is competition. The tech industry sometimes seems uncompetitive and even monopolistic. However, this is only true for multiple unique companies. Most companies, including Cisco, compete in a highly competitive environment. Cisco faces competition in particular because of its business transformation. Although it is a renowned hardware company, it still builds its brand in the software industry which is very different.

Moreover, the company not being very experienced in the business of software, it must face the risk of execution. The company has so far turned 30% of its revenue into software sales. The company is on track to complete the change, but that’s far from guaranteed. If the change stalls, it will have a profound impact on company direction and investor expectations, and hurt the stock price.

The last risk is the economic downturn. The growth of the world economy is causing growing concern. High inflation and consumption under higher rate pressure, and we have already seen the US economy shrink in the first quarter. Companies may be more reluctant to invest in information technology when the level of uncertainty is higher and growth is far from guaranteed.

conclusion

Cisco is another strong company that has so far managed to reinvent itself. The company transforms its business model and continues to slowly increase sales. EPS, on the other hand, is growing faster and has fueled growth in dividends and buyouts. The shares are trading for what I think is an attractive valuation, and the software’s business model has room to grow and grow revenue going forward.

The business has certain risks, with execution risk being unique to the business and not a cross-industry risk. However, I believe that, so far, the management has proven to be effective. Therefore, I think dividend growth investors should consider Cisco for their portfolio and add more stocks on future volatility declines.

Comments are closed.