Blend Labs Stock: A First Assessment (NYSE: BLND)

gesrey/iStock via Getty Images

If we were to grow old by thinking for ourselves at least once a year, only a handful of people would reach adulthood.. ”― Mokokoma Mokhonoana

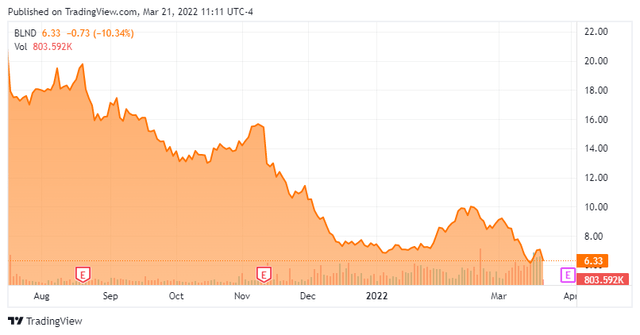

We take an in-depth look for the first time Mixing laboratories (NYSE: BLND). This small technology company made its market debut last summer. And like so many names of that’old‘, the actions quickly headed towards ‘Failed IPO‘ territory. So is this stock in the ‘good deal‘ after its great decline? We try to answer this question through the analysis below.

BLND Stock Chart (Looking for Alpha)

Company presentation:

Mixing laboratories is located in San Francisco. The company builds and operates cloud-based software platform solutions for financial services companies. Blend Labs offers a suite of white label products for mortgages, home loans as well as lines of credit, auto loans, personal loans, credit cards and deposit accounts. In fiscal year 2020, Blend Labs’ software platform helped financial services firms process nearly $1.4 trillion in loan applications. The company serves approximately one-third of the top 100 financial services companies in the United States. One of management’s visions for the company is to create a seamless journey from start to finish of the entire lending process. Four months before the company’s IPO, Blend Labs bought Title365, a leading provider of title insurance and settlement services for just over $400 million in consideration.

The stock currently trades at just over seven dollars per share and has an approximate market capitalization of $1.5 billion. The shares debuted in the market at $18.00 apiece in mid-July.

Third quarter results

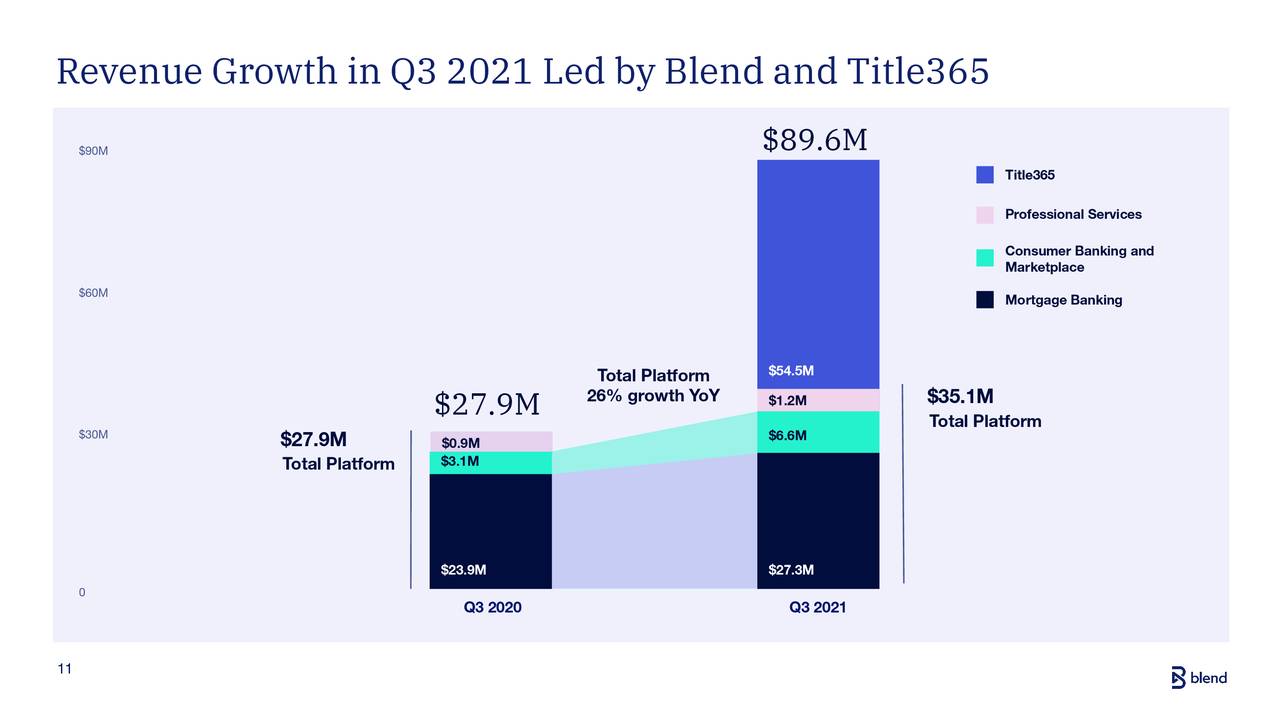

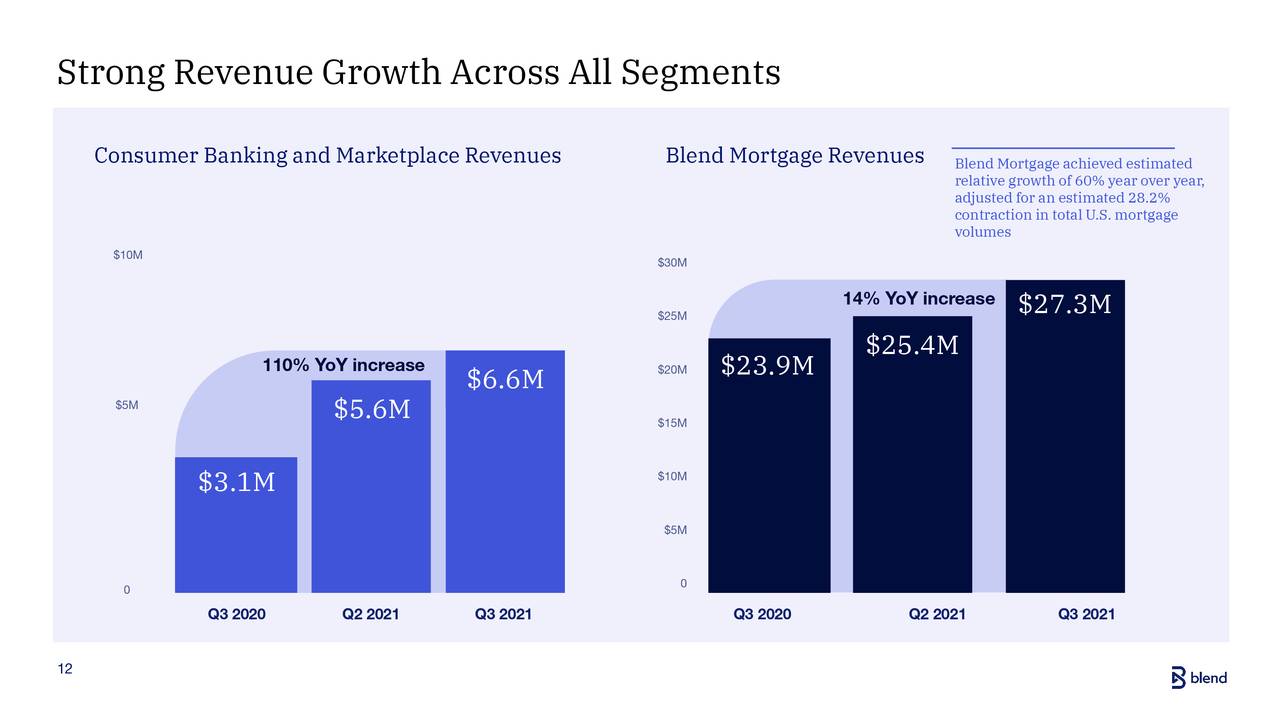

The company released its latest quarterly report results November 10. The company posted a GAAP loss of 38 cents per share, beating analysts’ expected loss of 15 cents per share. Overall revenue increased over 220% to just over $89.5 million. This higher figure beat the consensus. It should be noted that $54.5 million of this sum was provided by Title365. Revenue from the Blend Platform segment was $35.1 million. This is an increase of 26% year over year and 9% sequentially from the prior quarter.

BLND – Q3 Highlights (Presentation of the company in November)

Some other insights from the revenue report:

Management raised the midpoint of its full-year 2021 revenue forecast by $13 million.

Full-Year 2021 GAAP Revenue Forecast

|

in millions of dollars |

Gross revenue |

Adjusted gross/net revenue for Title365, H2 2021 impact |

Net revenue |

|

Previously issued GAAP guidance as of June 30, 2021 |

$226 – $232 |

($8) |

$218 – $224 * |

|

Revised GAAP guidelines as of September 30, 2021 |

$237 – $247* |

($8) |

$229 – $239 |

- Total banking transaction volume was just over 525,000, up 24% from 3Q2020.

- The company also launched its Blend Income Verification software product. This is something customers can add for an additional fee and so far over 50 customers have signed up for this feature.

- Blend Labs also added 17 financial services customers to its roster during the quarter. The largest of these, Prosperity Bank, has over $35 billion in assets.

Analysts’ comments and results:

The analyst community is somewhat mixed on Blend Labs’ outlook at the moment. Five analyst firms, including Piper Sandler and Goldman Sachs, have reissued or assigned buy ratings to the stock. However, three of them contain downward price target revisions. The current price targets offered range from $10 to $23 per share. In contrast, KeyBanc launched the shares as Market Perform with a price of $11.75 while UBS maintained its neutral rating and lowered its price target by one dollar to $10 per share.

The company ended 3Q2020 with just over $590 million in cash and marketable securities against $225 million in long-term debt after posting a non-GAAP operating loss of $21.1 million during the quarter. Insiders have only made a few small sales so far in 2022 and have sold less than $75,000 worth of shares in total since the company went public. Short-term interest in the stock is currently around eight percent.

Verdict

Currently analyst consensus the company is posting a loss of about 75 to 85 cents per share on a negligible increase in revenue to just over $345 million.

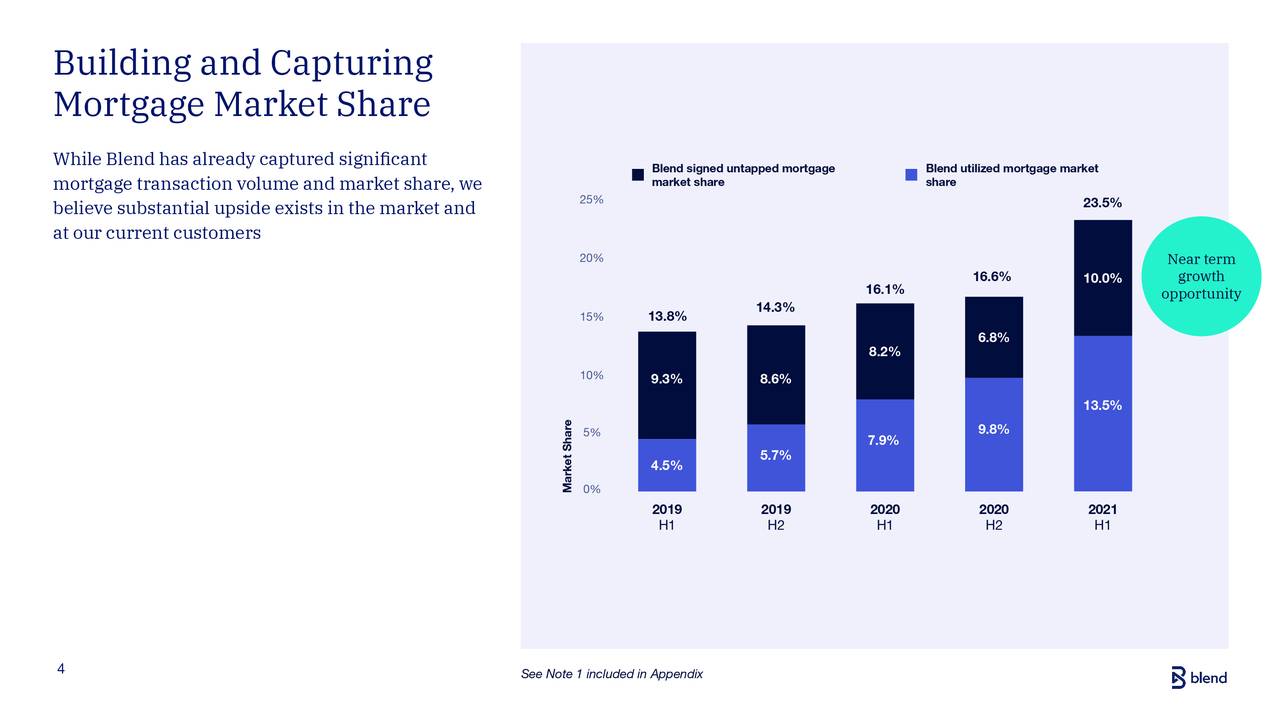

BLND – Mortgage Market Share (Presentation of the company in November)

The company is closely tied to the strength of the mortgage market. The ten-year Treasury yield crossed the 2.2% mark for the first time in more than three years and the average 30-year mortgage rate edged up to 4.3%, up from spending on the major part of last year at 3% or less.

Q3 Highlights – BLND (Presentation of the company in November)

Combined with the huge increases in housing prices over the past two years, affordability is becoming a major issue for the housing market. Existing February home sales posted a seven percent drop last week and weekly mortgage applications continue to fall.

This was the main reason why Truist Financial downgraded Blend Labs went from a buy to a hold this morning and cut its price target from $24 to $7.50 per share. Therefore, until the mortgage markets stabilize, I pass on any investment recommendations to Blend Labs even though I like the company’s business model and its balance sheet looks rock solid at the moment. We should get fourth quarter results and an updated set of data points overnight.

Those who have money are eccentric. Those without, crazy. -Bruce Robinson

Bret Jensen is the founder and author of articles for the Biotech Forum, the Busted IPO Forum and the Insiders Forum

Comments are closed.