2U stock: the same declining story as ever (NASDAQ: TWOU)

Alistair Berg/DigitalVision via Getty Images

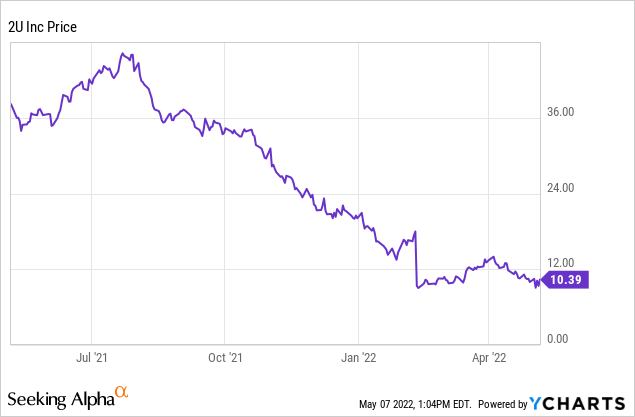

While I think few of the sharp corrections we’ve seen year-to-date in the tech sector have been justified, 2U’s (NASDAQ: TWO) falling out of favor has been more than fitting given recent company fundamentals circumstances. The online education company, which also recently bought popular e-learning website edX, has struggled to increase enrollment at a time when schools have reopened, the job market is tight and workers are more likely to get well-paying jobs than to return for degrees.

Year-to-date, 2U’s shares have crashed more than 50%, while the stock also remains down more than 85% from highs above $90 hit in 2018.

2U has just released first quarter results, and after a disastrous fourth quarter in which the stock lost half its value for posting a very disappointing 2022 growth forecast, the roughly 10% rally after the first quarter was a good relief for the bulls.

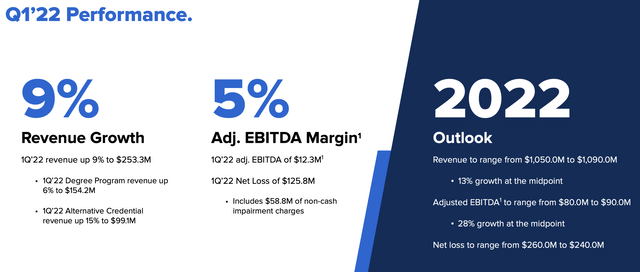

The main cause of the post-earnings spike is 2U’s improved profitability, although I must add the caveat that the improvements are rather tiny and don’t really save this difficult story.

2U FY22 Outlook (2U Q1 Earnings Record)

For FY22, while 2U maintained its initial growth outlook of 13% annual growth (which devastated the stock when the guidance was introduced in the fourth quarter), the company raised its adjusted EBITDA guidance at $80-90 million, up $10 million on both ends from an earlier view of $70-80 million. The increase represents approximately ~1% of the increase in adjusted EBITDA margin, in a range of 7.6% to 8.3%.

While it’s understandable that slightly more favorable profitability measures have moved the stock so strongly at a time when investors are looking for safety, I remain bearish on 2U – for me it remains a company with sinking prospects.

The problem with 2U

There are two main issues I see with 2U that keep me from being optimistic about the company’s future.

The first is the company’s reputation. While 2U markets itself as enabling online learning, it is essentially a for-profit university. Although it partners with reputable universities (its first client was USC), it actually derives its income from a tuition reduction.

Last year, 2U’s business model was widely exposed in a the wall street journal profile that claimed that 2U and USC were using predatory marketing tactics to lure students into very expensive ($115,000) degree programs that ultimately resulted in low-paying jobs, burdening those students with crippling debt.

Considering the bad reputation that 2U has already generated, it is hard to believe that 2U can really become a standard mode of education that can find a mainstream student base.

The second problem concerns the business model of 2U itself. When partnering with a university to set up a new course, 2U bears all the costs of digitizing the course content, setting up the online teaching platform, and even the cost of marketing the course. program to students, in exchange for a reduction in tuition fees. . 2U’s business model really isn’t that different from being a franchise operator of a larger brand.

Where this differentiates 2U from other software vendors is that every engagement must be personalized. While most software companies can create a product that can be sold to all of their customers, 2U’s setup costs are only incurred for a particular course – which may or may not see successful enrollment. As such, I find it hard to believe that 2U can significantly improve its results.

Q1 results show slowing growth, leveraged balance sheet

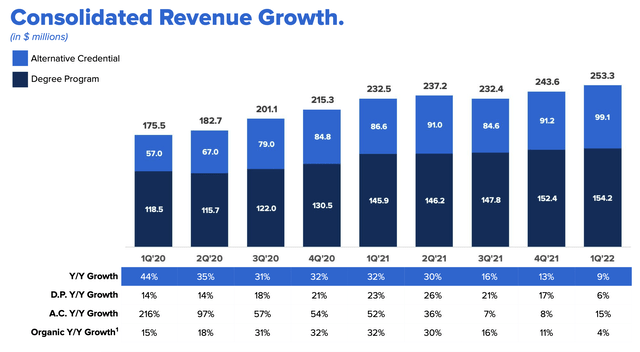

The most recent results from 2U also do not show a dynamic story. Take a look at the company’s revenue trends through Q1 in the chart below:

Q1 2U revenue (Q1 2U revenue)

Overall revenue for the quarter increased 9% year-on-year to $253.3 million, essentially in line with Wall Street estimates – but in deceleration of four points from one quarter to another.

More to the point above, note that the majority of this revenue growth was also inorganic. Organic revenue only grew at a 4% year-over-year pace, decelerating seven points quarter-over-quarter and posting the worst organic growth rate in years.

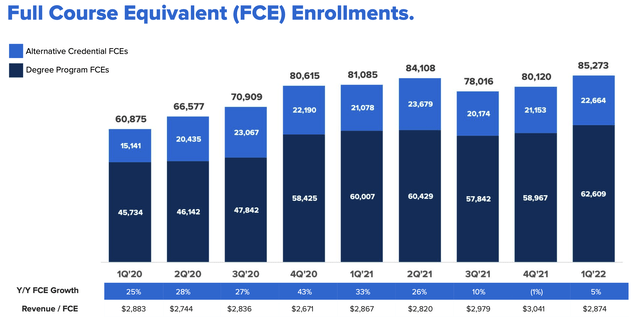

Full course enrollment growth has also been relatively slow, increasing 5% YoY, as shown in the chart below (mostly due to low-income alternative degree programs, up 8% YoY enrollment, compared to 4% growth for full degree programs):

2U FCE (2U Q1 gain bridge)

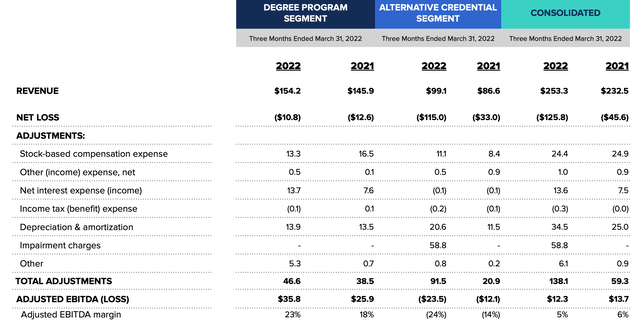

2U’s Adjusted EBITDA margins also declined year over year. Total Adjusted EBITDA in Q1 decreased -10% YoY to $12.3m, while Adjusted EBITDA margins of 5% slipped one point year over year . This was driven by inflated losses in the alternate credential segment (which, unfortunately, is also the segment fueling 2U’s growth right now):

2U adjusted EBITDA per segment (2U Q1 result)

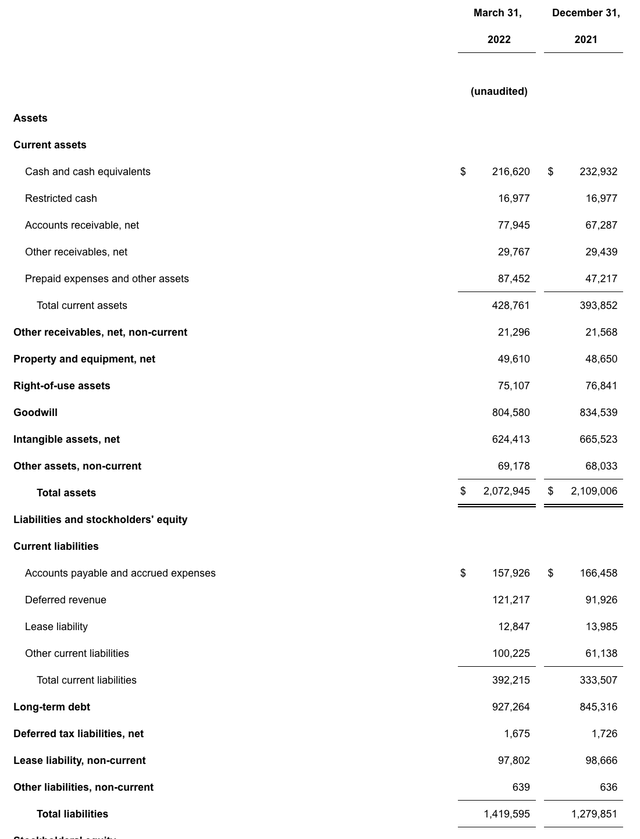

It’s worth pointing out that 2U’s declining profitability weighs on an already tight balance sheet. At the end of the first quarter, 2U had $216.6 million in cash on its books, along with a massive debt of $927.3 million – or $710.7 million in net debt.

2U balance sheet (2U Q1 results bridge)

Compared to the midpoint of $80 million to $90 million in adjusted EBITDA the company expects to generate this fiscal year, 2U’s debt ratio stands at 8.4x Adjusted EBITDA – which is incredibly optimized; the standard definition of a “highly leveraged” business typically indicates a threshold of around 3x Adjusted EBITDA.

Declining organic growth, slow enrollment growth, shrinking adjusted EBITDA margins and huge leverage profile – is there really anything positive in the 2U story?

Key points to remember

2U remains an incredibly risky story. Despite the dramatic drop in highs and the fact that 2U trades just over around 1x forward earnings, I remain skeptical of the longevity of the company’s brand and the sustainability of its business model. Continue to stay away here.

Comments are closed.